Is Leap Year a lucky year for stocks?

Leap day is here, and investors may be wondering if a date associated with crazy topsy-turvy traditions has any significance for the stock market. So far in 2024, we’ve experienced a pretty nice stock market rally with the S&P 500 Index up 6.5% and the Dow Jones Industrial Average Index up 3.60% year to date.

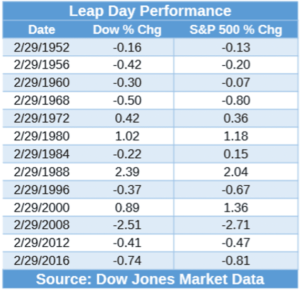

The answer, though it should be taken with a grain of salt, is that leap day has tended to be not so lucky for stock-market investors over the years. The S&P 500 Index and Dow Jones Industrial Average Index have both tended to decline on leap day, which is added to the calendar every four Februarys.

Why the grain of salt? The sample size is quite small and likely not sufficient to pass muster with statistically minded traders.

Nevertheless, it’s still worth being aware of the potential for lower than usual stock market returns on leap day, observing that for those more inclined to track recent trends, the stock indexes have fallen on each of the last three Leap Days when the market was open. Feb. 29 fell on a Saturday in 2020, the most recent leap year.

According to Dow Jones Market Data, the S&P 500 has seen a median fall of 0.3% on the 13 Leap Days going back to 1952. That compares with a median rise of 0.05% for the index on all other days since 1950. The S&P 500 has turned in a positive performance on just four of those Leap Days, or 31% of the time, versus a 52% positive rate on all other days.

It’s a similar story for the Dow, with the blue-chip gauge posting a median decline of 0.13% on leap day versus a median 0.05% gain on all other days. It’s up just 38% of the time on leap day, versus 53% for all other days.

So far, leap day has been a mixed bag. Stocks opened on a positive note after a closely watched inflation reading matched Wall Street expectations, but the Dow has since drifted into negative territory while the S&P 500 holds on to a small daily gain.