A bear market is defined as a decline of 20% or more. Over the last week, the stock market has declined and left the S&P 500 Index at -20%+. All of us are worried and not feeling great about watching our hard-earned savings continually drop. We are also hearing about a coming recession – when unemployment is high, layoffs begin, the stock market drops, and inflation increases. Sounds all too familiar right now.

A bear market is defined as a decline of 20% or more. Over the last week, the stock market has declined and left the S&P 500 Index at -20%+. All of us are worried and not feeling great about watching our hard-earned savings continually drop. We are also hearing about a coming recession – when unemployment is high, layoffs begin, the stock market drops, and inflation increases. Sounds all too familiar right now.

We’ve been telling clients NOT to rebalance as the entire market is declining. Rebalancing will just lock in losses and there is no safe place to rebalance into except cash. High yield online savings rates are around 1%. That will provide a floor and stop the declines. But with inflation hovering around 9%, cash will not be the asset class to recover your lost returns and put your portfolio back in positive territory. We have recommended diversified portfolios with adequate cash reserves for all the clients we work with. This is the best way to weather this type of market volatility.

Why Asset Allocation is SO important for volatile markets

There are a lot of platitudes in investing and one of the most misunderstood is that “asset allocation is responsible for over 90% of a portfolio’s return.” A research paper written back in 1986 actually found that over 90% of a portfolio’s asset allocation is responsible for a portfolio’s volatility. In a well-diversified portfolio – those that we have created for our clients – volatility is diminished as shown on the graph below. Unfortunately, investors inadvertently started using performance and volatility interchangeably – which they are not.

In the simplest terms, assets that are more volatile traditionally have had the most opportunity to produce greater returns…or greater losses, whereas more stable assets have had more consistent returns (think fixed income before 2022!).

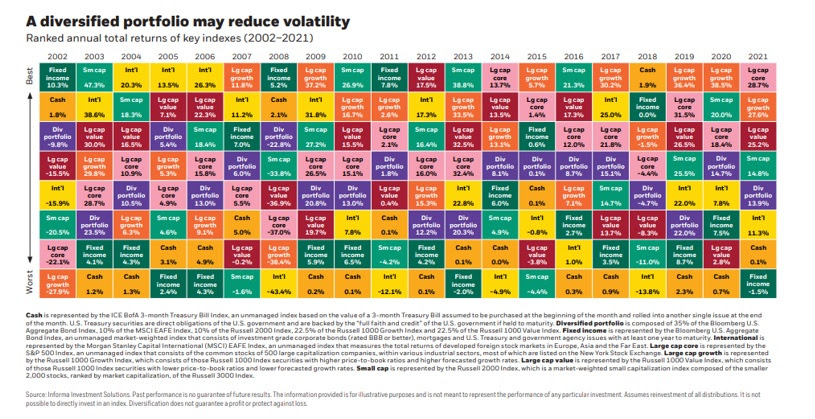

One of our favorite charts (above) – this one from BlackRock Investments, LLC – shows the returns of each of the major asset classes over time. When you look at this chart closely it makes sense that large cap growth (the orange boxes) has often been the best. But in down markets has trended toward being the worst since it has the highest volatility.

Many of our clients are justifiably uncomfortable in this current bear market. It is unnerving to watch the value of your hard-earned savings declining. If it is difficult to withstand the ups and downs of the market when invested in equities. But when a portfolio is diversified (the purple boxes above), the volatility, and also performance, will be smoothed out. Many people like being in a diversified portfolio in down markets because their performance decline is minimized, but in bull markets can be disappointed that they didn’t get the highest returns – but that is the price you pay for smoothing out volatility.

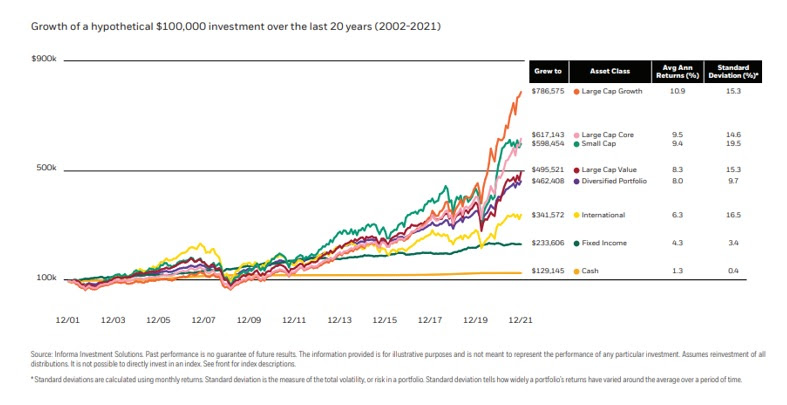

Another great chart below (also from BlackRock) – answers the question “how does that work out over 20 years?” There have been some major ‘meltdowns’ in the stock market – 9/11, the 2008 Mortgage Crisis, various Presidential elections, and then Covid. But if you invested $100,000 back in December of 2001 in a diversified portfolio, 20 years later you would have $462,408 and if you had the fortitude to be in large cap growth you would have $786,575! And, unfortunately, if you were all in cash, when you factor in inflation, you actually lost money.

We understand it’s hard when you are in the middle of a volatile period, as we are now, to know which direction to take. The instinct is to sell the losers in this market and buy the winners. But here’s another truism – “past performance does not indicate future return.” When you look at the chart above, there is comfort in knowing that when the stock market was in some of the darkest periods – 9/11, the Mortgage Crisis and Covid – historically, the equities market has always come back!

Lastly, as you think about getting out or rebalancing, be aware that pretty much everything is in negative territory. As we’ve said before, we are recommending staying invested and try not to fixate on the daily stock market gyrations!

Source: 2022 BlackRock Investments, LLC, member FINRA, data from Informa Investment Solutions

Past performance is no guarantee of future results. The information provided is for illustrative purposes only and is not meant to represent the performance of any particular investment. Diversification does not guarantee a profit or protect against a loss.