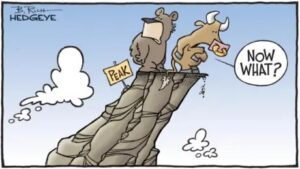

The markets have not had a good year so far

We’ve been receiving many concerned calls and emails from clients wondering what is happening with the market and if they should take any action.

We’ve been receiving many concerned calls and emails from clients wondering what is happening with the market and if they should take any action.

We are recommending clients hold steady and are not rebalancing any portfolios based on current market activity.

What a Week!

The Federal Reserve just raised the Fed Funds rate last Wednesday by 0.50%. A quick search found that one-year CD rates – previously around 1% – have now increased to around 2.25%. We expect to see rates on FDIC high yield savings rates and CDs continue to increase as the Fed plans to raise rates at subsequent meetings in an effort to stamp out inflation.

As a result, the stock market increased over 900 points last Wednesday only to drop more than 1,000 points on Thursday. The S&P 500 is extremely volatile moving from -9% YTD to -12% YTD in a week. A decline of over 10% puts us in correction territory.

Across the board most major market indices are in negative territory YTD (5/6/2022):

– Bond Market Index -10.53%

– Mid Cap Index -12.34%

– Small Cap Index -13,40%

– International Index -14.50%

– Technology Index -23.17%

Why it makes sense to stay the course…..

Market timing is very difficult and it’s very hard for an individual investor to do it well. (It’s also hard for full time market analysts to do it well!). We recommend clients do not panic or make sudden moves.

Market timing is very difficult and it’s very hard for an individual investor to do it well. (It’s also hard for full time market analysts to do it well!). We recommend clients do not panic or make sudden moves.Selling off or rebalancing investments at this time will be locking in losses. There are no solid positively performing investment options at this point. As we’ve said in the past, market volatility is one risk factor that a solid financial plan with good diversification will help insulate you against.

For those who have been working with us for a while, remember we have a plan!! When we build our portfolios, we take into account asset allocation, so your portfolio is diversified. For those investors near/in retirement or who have conservative risk tolerances, we have built your portfolio with a bond and cash cushion for exactly this type of market.

If you decide to sell, the only move would be to into cash. Yes, that stops further losses, but also prevents any rebound gains. It is virtually impossible to decide when to reinvest. We know from experience, those who stay invested are rewarded when the market rebounds. Because of the market uncertainty and the low return outlook for investments over the midterm, we recommend you weather the storm and stay invested.

If a client has a need to sell because they need funds for their goals or to satisfy their RMD, we are reviewing portfolios and making recommendations.

For those who have been sitting on the sidelines with a good portion of their savings in cash, a market correction represents an opportunity to invest when prices are low – IF your risk tolerance can handle further volatility. No one knows if the next market drop represents the bottom or the beginning of a deeper slide. For clients primarily in cash holdings, dollar cost averaging–investing in a bit at a time–can be a good way to balance your portfolio and ‘dip your toe in slowly’.

Investors have short term memories. Remember are coming out of an 11 yr. bull market and last year the S&P 500 Index ended the year up almost 29%. We are down (10%) – (12%) YTD so you are still winning!

Having a plan is like building an ocean tanker. It should be designed to stay afloat in rough waters. When you hit a storm, you wouldn’t jump off into a dingy. In other words, stick to your plan!

Nothing in life or your finances is a guarantee. But having a well-designed plan makes navigating these rough patches easier.